Bank of Canada Rate Cut Expectations

Investors and economists closely monitor the Bank of Canada’s monetary policy decisions, particularly regarding interest rates. These decisions can significantly impact various economic factors, including borrowing costs, consumer spending, and investment. January’s jobs report holds particular importance as it provides crucial insights into the labor market’s health, which, in turn, influences rate cut expectations.

Overview of January’s Jobs Report

The January jobs report serves as a key indicator of the Canadian economy’s performance. It offers insights into employment trends, job creation, unemployment rates, and wage growth, among other factors. Analysts scrutinize this data to assess the overall health of the labor market and to anticipate the Bank of Canada’s potential actions regarding interest rates.

Importance of Employment Data in Monetary Policy

Employment data is one of the primary metrics central banks like the Bank of Canada rely on when formulating monetary policy. A robust job market often indicates economic strength, prompting policymakers to consider tightening monetary policy to prevent inflation. Conversely, weak employment figures may lead to discussions of rate cuts to stimulate economic activity.

Factors Influencing Bank of Canada’s Rate Decisions

Several factors influence the Bank of Canada’s decisions regarding interest rates. These include inflation rates, economic growth forecasts, international economic conditions, and, significantly, employment data. A comprehensive understanding of these factors is crucial for accurately predicting the central bank’s future moves.

Impact of Economic Indicators on Rate Cut Expectations

Economic indicators, such as the jobs report, play a vital role in shaping rate cut expectations. Strong employment figures typically reduce the likelihood of rate cuts as they suggest a robust economy. Conversely, disappointing job numbers can heighten expectations for rate cuts, as policymakers may seek to stimulate job creation and economic growth.

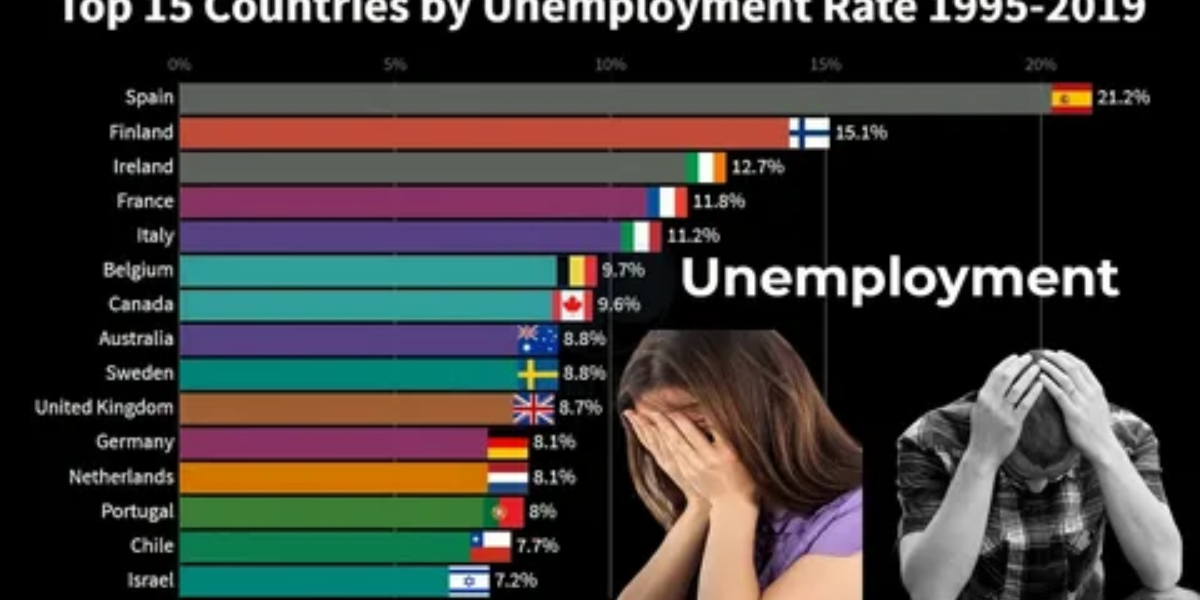

Analysis of Unemployment Rate Trends

The unemployment rate is a key component of the jobs report and offers valuable insights into labor market dynamics. A declining unemployment rate indicates increased job opportunities and economic vitality, potentially dampening expectations for rate cuts. Conversely, a rising unemployment rate may signal economic weakness, prompting discussions of rate cuts to spur employment.

Wage Growth and Its Implications

Wage growth is another crucial aspect of the jobs report. Rising wages can stimulate consumer spending and inflation, potentially leading to discussions of tightening monetary policy. Conversely, stagnant or declining wages may prompt policymakers to consider rate cuts to support household income and stimulate economic activity.

Sectoral Employment Insights

Examining employment trends across different sectors provides valuable insights into the economy’s overall health. Strong job growth in sectors such as manufacturing, technology, and healthcare may suggest robust economic expansion, influencing rate cut expectations. Conversely, significant job losses in key sectors could raise concerns and lead to discussions of rate cuts.

COVID-19’s Influence on Labor Market Dynamics

The COVID-19 pandemic has significantly impacted labor market dynamics, leading to unprecedented challenges and disruptions. Understanding how the pandemic continues to affect employment trends is crucial for accurately assessing rate cut expectations. Factors such as vaccination rates, government policies, and the emergence of new variants all play a role in shaping labor market dynamics and, consequently, rate cut expectations.

Market Reaction to Jobs Report

Financial markets often react swiftly to the release of the jobs report, as investors adjust their expectations based on the latest economic data. Positive employment figures may lead to increased confidence in the economy, potentially resulting in higher bond yields and a stronger currency. Conversely, disappointing job numbers can trigger market volatility, with investors anticipating potential rate cuts and adjusting their portfolios accordingly.

Previous Bank of Canada Rate Cuts and Their Effects

Examining past rate cut decisions by the Bank of Canada and their effects on the economy provides valuable insights into potential future actions. Understanding how the central bank has responded to similar economic conditions in the past can help investors and economists better anticipate its future moves and their potential impact on the economy.

Expert Opinions and Forecasts

Gauging expert opinions and forecasts regarding rate cut expectations can provide additional insights into market sentiment. Economists, analysts, and policymakers often offer their perspectives on the likely direction of interest rates based on their analysis of economic data and broader macroeconomic trends. Considering a range of expert opinions can help investors make more informed decisions. Prospects for Rate Cut and Economic Outlook

January’s jobs report holds significant implications for Bank of Canada rate cut expectations. A thorough analysis of employment data, wage growth, sectoral trends, and the broader economic landscape is essential for accurately assessing the central bank’s potential actions. While strong job numbers may dampen expectations for rate cuts, ongoing uncertainties, such as the impact of COVID-19, warrant careful monitoring. Ultimately, investors and policymakers must stay vigilant and adapt their strategies based on evolving economic conditions and central bank decisions.

Click here for more visited Posts!