Understanding Home Loan Mortgage Rates: A Beginner’s Guide

Securing a home loan is a significant financial decision, and one of the crucial aspects to consider is the mortgage rate. Whether you’re a first-time homebuyer or looking to refinance, understanding how mortgage rates work can save you thousands of dollars over the life of your loan.

Factors That Influence Home Loan Mortgage Rates

Mortgage rates aren’t set in stone; they fluctuate based on various factors. Lenders consider economic indicators like inflation, unemployment rates, and the economy’s overall health when determining mortgage rates. Your credit score, loan amount, loan term, and down payment percentage also influence the rate you’re offered.

Fixed vs. Variable Mortgage Rates: Which Is Better?

When choosing a mortgage, you’ll encounter fixed and variable rates. Fixed-rate mortgages offer stability, with your interest rate remaining constant throughout the loan term. On the other hand, variable-rate mortgages fluctuate with market conditions, potentially offering lower initial rates but posing risks of rate increases in the future.

How to Find the Best Home Loan Mortgage Rates

Shopping around is crucial when looking for the best mortgage rates. Compare rates from multiple lenders, including banks, credit unions, and online lenders. Additionally, consider working with a mortgage broker who can help you navigate the complexities of mortgage rates and find the best deal for your situation.

Tips for Negotiating Better Mortgage Rates

Negotiating your mortgage rate is possible, especially if you have a strong credit history and financial profile. Use competing offers from different lenders as leverage, and be bold and ask for discounts or concessions. Remember, even a slight reduction in your mortgage rate can lead to significant savings over time.

The Role of Credit Scores in Securing Low Mortgage Rates

Your credit score is crucial in determining the mortgage rate for which you qualify. Lenders use your credit score to assess your risk as a borrower; the higher your score, the lower the interest rate you’re likely to receive. Maintaining a healthy credit score by paying bills on time and managing debt responsibly can help you secure the lowest possible mortgage rate.

Comparing Mortgage Rates from Different Lenders

Refrain from settling for the first mortgage offer you receive. Take the time to compare rates from multiple lenders to ensure you’re getting the best deal. When comparing offers, consider factors like the interest rate, closing costs, and loan terms. Online comparison tools can streamline the process and provide valuable insights into mortgage options.

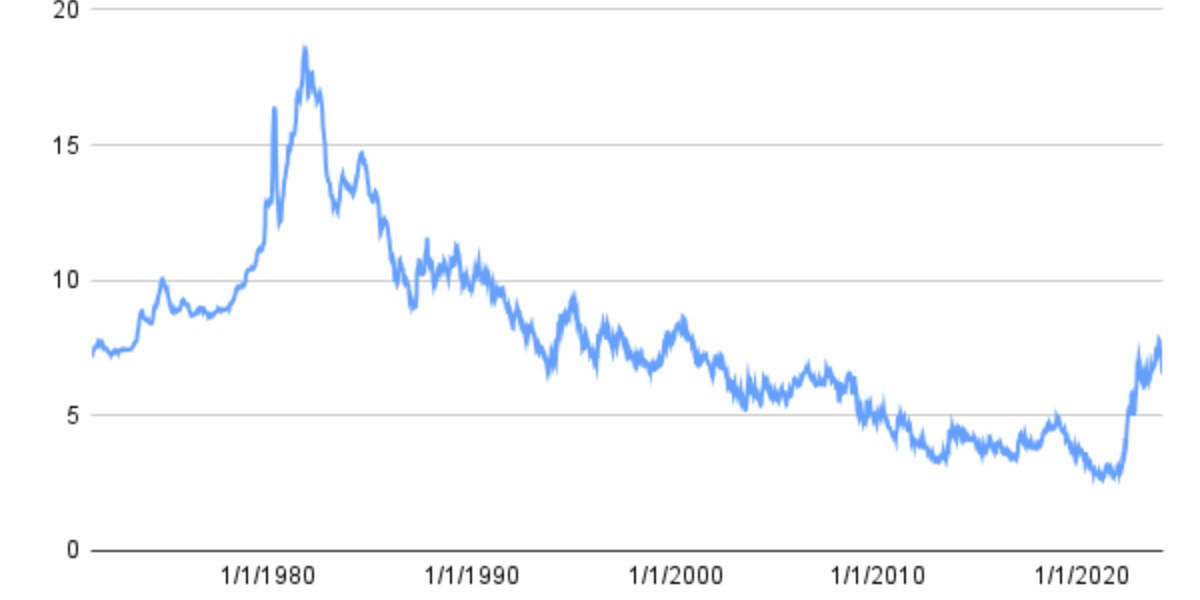

Mortgage Rate Trends: What to Watch For

Keeping an eye on mortgage rate trends can help you time your home purchase or refinance strategically. Monitor financial news and economic indicators to gauge where rates might be headed. Additionally, consider consulting with a financial advisor or mortgage professional for personalized insights into current market conditions.

How Economic Factors Impact Mortgage Rates

Mortgage rates are closely tied to broader economic trends. Inflation, employment data, and central bank policies influence interest rates. Understanding these economic indicators can give you a better grasp of why mortgage rates fluctuate and help you make informed decisions about your home loan.

The Difference Between Interest Rate and APR in Mortgages

When comparing mortgage offers, it’s essential to understand the difference between the interest rate and the annual percentage rate (APR). While the interest rate represents the cost of borrowing, the APR includes additional fees associated with the loan. Comparing APRs can give you a more accurate picture of the total cost of each mortgage option.

Mortgage Rate Lock: Is It Worth It?

A mortgage rate lock allows you to secure a specific interest rate for a set period, protecting you from potential rate increases while processing your loan. While rate locks provide peace of mind, they typically come with expiration dates and may involve fees. Consider your timeline and risk tolerance when deciding whether to lock in your rate.

Strategies for Refinancing to Secure Lower Mortgage Rates

Refinancing your mortgage can be a smart move to lower your interest rate and reduce your monthly payments. However, timing is critical. Monitor mortgage rate trends and consider refinancing when rates are lower than your current rate. Additionally, factor in closing costs and potential savings to determine if refinancing makes financial sense.

Frequently Asked Questions About Home Loan Mortgage Rates

How often do mortgage rates change?

Can I negotiate my mortgage rate?

What credit score do I need to qualify for the best rates?

Should I choose a fixed or variable-rate mortgage?

How do economic factors influence mortgage rates?

Click here for more visited Posts!