Are you looking to buy a home? Or maybe you’re considering refinancing your existing mortgage? Either way, one of the most crucial factors to consider is the interest rate on your home mortgage. In this article, we’ll dive into everything you need to know about securing the best home mortgage interest rates.

Understanding Home Mortgage Interest Rates

First things first, let’s understand what home mortgage interest rates are. Simply put, it’s the cost you pay the lender for borrowing money to purchase a home. This rate is expressed as a percentage of the total loan amount and can significantly affect your monthly mortgage payments and overall affordability.

Factors Affecting Home Mortgage Interest Rates

Several factors influence home mortgage interest rates. Economic conditions, inflation rates, and the overall state of the housing market play significant roles. Additionally, your credit score, loan term, and the type of mortgage you choose also impact the interest rate you’re offered.

How to Find the Best Home Mortgage Interest Rates

Finding the best home mortgage interest rates requires research and comparison shopping. Start by checking with multiple lenders, including banks, credit unions, and online lenders. Don’t forget to explore government programs that offer competitive rates for eligible borrowers.

Fixed vs. Adjustable Rate Mortgages: Which is Better?

When choosing a mortgage, you’ll likely encounter both fixed and adjustable-rate options. Fixed-rate mortgages offer stability with a consistent interest rate throughout the loan term, while adjustable-rate mortgages (ARMs) typically start with lower rates but can fluctuate over time. Consider your financial situation and risk tolerance when deciding which type is best for you.

Tips for Qualifying for Lower Interest Rates

Improving your credit score, reducing your debt-to-income ratio, and saving for a larger down payment are effective ways to qualify for lower interest rates. Lenders view borrowers with strong financial profiles as less risky, often resulting in better loan terms.

The Role of Credit Score in Mortgage Rates

Your credit score is a crucial factor in determining the interest rate you’ll be offered. Generally, borrowers with higher credit scores are eligible for lower interest rates, as they’re perceived as less likely to default on the loan. Monitor your credit score regularly and take steps to improve it before applying for a mortgage.

Comparing Different Mortgage Lenders

Don’t settle for the first mortgage offer you receive. Take the time to compare quotes from multiple lenders to ensure you’re getting the best deal. Consider not only the interest rate but also closing costs, loan terms, and customer service reputation when making your decision.

Government Programs for Low Mortgage Rates

Explore government-backed mortgage programs like FHA loans, VA loans, and USDA loans, which often offer competitive interest rates and more flexible qualification requirements. These programs are designed to help individuals and families achieve homeownership, particularly those with limited financial resources.

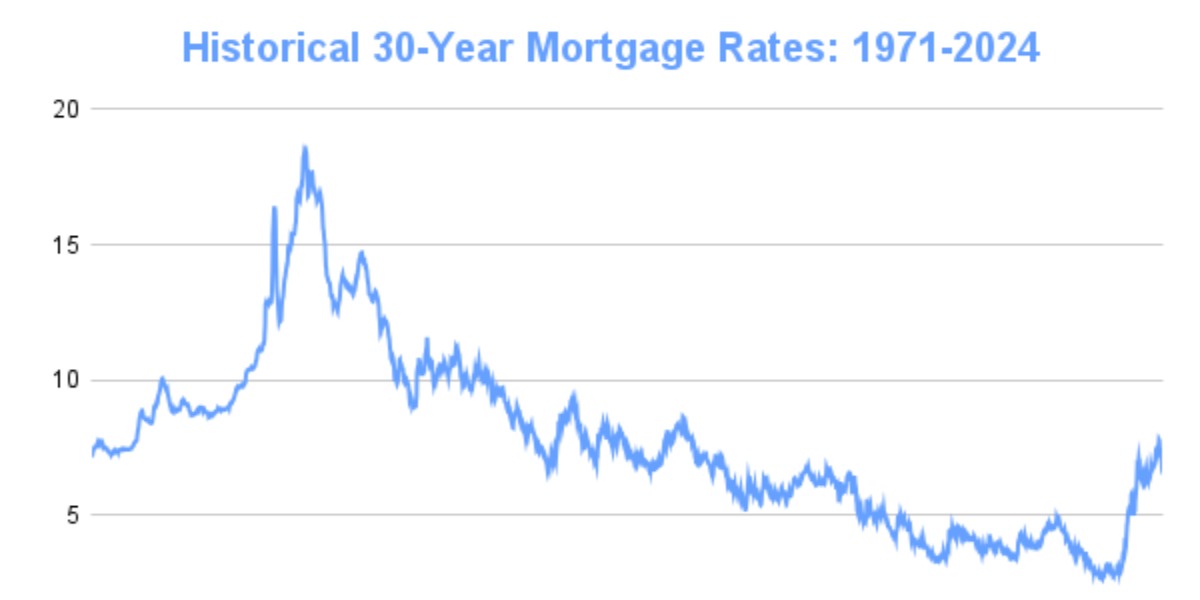

Mortgage Rate Trends: What to Watch For

Stay informed about mortgage rate trends by following economic news and market updates. Factors such as Federal Reserve decisions, employment data, and housing market conditions can influence interest rates. Keep an eye on rate forecasts to time your mortgage application for the most favorable conditions.

Negotiating Your Mortgage Interest Rate

Don’t hesitate to negotiate with lenders to secure a better interest rate. Use competing offers as leverage and be prepared to walk away if you’re not satisfied with the terms. Remember, lenders want your business, so it’s worth advocating for yourself to get the best deal possible.

Hidden Costs Behind Low Mortgage Rates

While low mortgage rates may seem attractive, be aware of potential hidden costs. Some lenders may tack on additional fees or offer lower rates with stricter terms or prepayment penalties. Read the fine print carefully and ask questions to fully understand the true cost of the loan.

Planning for Mortgage Rate Fluctuations

Keep in mind that mortgage rates can fluctuate over time. Consider factors like future interest rate adjustments for adjustable-rate mortgages and potential refinancing opportunities to mitigate the impact of rate fluctuations on your monthly payments.

Securing the Best Home Mortgage Interest Rates

Securing the best home mortgage interest rates requires careful research, comparison shopping, and strategic planning. By understanding the factors that influence rates, improving your financial profile, and exploring all available options, you can find a mortgage that meets your needs and helps you achieve your homeownership goals. Take the time to explore your options and make informed decisions to ensure you get the best deal possible on your home loan.

Click here for more visited Posts!