Bank of Canada Rate Hikes

The Bank of Canada’s decisions regarding interest rates play a pivotal role in shaping the Canadian economy. Understanding the rationale behind rate hikes is essential for individuals and businesses alike, as they can have significant implications on borrowing costs, spending patterns, and overall economic activity.

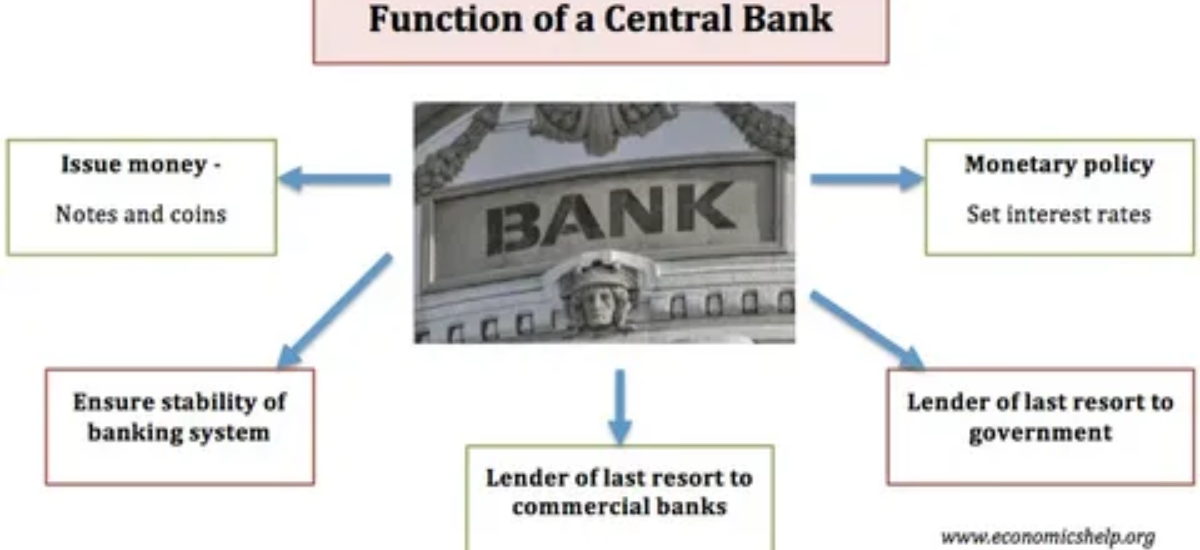

Understanding Monetary Policy

Monetary policy refers to the actions undertaken by a central bank, such as the Bank of Canada, to regulate the economy’s money supply and achieve macroeconomic objectives. One of the primary tools at the disposal of central banks is the adjustment of interest rates, which influences borrowing and spending behavior.

Recent Rate Hikes by the Bank of Canada

In recent times, the Bank of Canada has embarked on a path of gradually increasing interest rates. These rate hikes are driven by various factors, including inflationary pressures, economic growth expectations, and financial stability concerns.

Economic Factors Influencing Rate Decisions

The Bank of Canada closely monitors a range of economic indicators to assess the health of the economy and determine appropriate monetary policy actions. Key factors influencing rate decisions include inflation trends, employment levels, GDP growth, and international trade dynamics.

Impact of Rate Hikes on Borrowers

For borrowers, such as homeowners with variable-rate mortgages or individuals with floating-rate loans, rate hikes translate into higher borrowing costs. This can put pressure on household budgets and lead to decreased discretionary spending.

Effect on Consumer Spending

Higher interest rates can dampen consumer spending, as borrowing becomes more expensive. This can have ripple effects across various sectors of the economy, impacting retail sales, automotive sales, and other discretionary expenditures.

Implications for Businesses

Businesses also feel the impact of rate hikes, particularly those that rely on borrowing to finance operations or invest in expansion projects. Increased borrowing costs can constrain investment decisions and potentially slow down economic growth.

Housing Market Dynamics

The housing market is particularly sensitive to changes in interest rates. Higher rates can lead to reduced affordability for homebuyers and dampen demand for housing, which may eventually exert downward pressure on home prices.

International Context and Exchange Rates

The Bank of Canada’s rate decisions can also influence the value of the Canadian dollar relative to other currencies. Higher interest rates may attract foreign capital inflows, leading to currency appreciation, which can have implications for export competitiveness and international trade.

Potential Risks and Uncertainties

While the Bank of Canada aims to strike a balance between supporting economic growth and controlling inflation, there are inherent risks and uncertainties associated with monetary policy decisions. External factors, such as geopolitical tensions or unexpected shifts in global financial markets, can complicate the outlook.

Outlook for Future Rate Hikes

Looking ahead, the trajectory of interest rates will depend on how various economic factors evolve. The Bank of Canada has signaled its intention to continue normalizing monetary policy gradually, but the pace and timing of future rate hikes will be contingent on incoming data and economic developments.

Strategies for Individuals and Businesses

In light of potential future rate hikes, individuals and businesses should assess their financial positions and consider strategies to mitigate risks. This may include refinancing debt at fixed rates, building a financial buffer, or adjusting investment portfolios to withstand higher interest rates.

Navigating the Path Ahead

As the Bank of Canada continues its journey of normalizing interest rates, stakeholders across the economy must remain vigilant and adaptable. By understanding the implications of rate hikes and proactively managing their finances, individuals and businesses can navigate the path ahead with confidence and resilience.

Click here for more visited Posts!